Demystifying Hard Money Lenders

Hard money lenders seem to be everywhere these days with deals that seem too good to be true. Where there are plenty of those that prey on new investors, convince them to pay some fee for access to all kinds of money, only to never hear from that so-called lender again. I’ve written how to spot these scammers in a previous blog post. You can read that post HERE.

Hard money lending is a viable business, and there are many hard money lenders that are truly in business to serve real estate investors like us. I want to share with you how a good hard money lender operates, and how you can find the lender that is right for you without doing what I did – get my credit hit with 15 hard inquiries from lenders only to find they were all pretty much the same.

The credit experts say that inquiries have little affect on your credit score, but I can tell you that as these inquiries have fallen off my record, my score has increased by 100 points. That’s a big difference for someone struggling to exceed 700.

The Common Theme with Hard Money Lenders

To understand the hard money lending business, you have to put yourself in their shoes. They are in the business of making money and not losing money. Therefore they look at 2 critical criteria:

- Can we liquidate the asset to retrieve our funds if necessary?

- Can the borrower satisfy their commitment?

These may seem like two very simple issues, but there is a lot of complexity to go into this.

Value of the Asset

Real Estate investing has certain risks. No hard money lender will cover 100% of the cost of your project. None. If they say they will, then RUN AWAY as fast as you can. This is likely one of the scammers I mention that will want a fee up-front.

Therefore you must expect to bring in a certain amount of cash to share the risk with the hard money lender. The amount will vary on the lender, but my experience is that it’s anywhere from 15% to 35% of the purchase price of the property. The interest rate they charge will reflect the risk accordingly. For example, if you want them to fund 60% of the purchase price, then your interest rate will be much more favorable than if you want them to fund 85% of the purchase price.

Think about it. If they fund 100% of the project, how will they retrieve their funds from the project should you default? Let’s say the property costs $100k, and they finance $100k. They expect their interest payments (as they most likely borrowed these funds) on a regular basis. They need to incur expenses of their cost to the money, plus the cost to try to collect the funds, plus legal fees and time spent on the foreclosure process and then reselling to recoup their investment. A reputable hard money le

nder will never put themselves in that position; lending without their investment well protected but the value of the asset.

Now you may find someone to help you with the rest of the funds, and that is referred to as GAP Funding. But know, that is a much higher risk and you will have to sacrifice much of your profits for this level of funding. You can read more about GAP Funding HERE.

Quality of the Borrower

The quality of the borrower as a project manager/business person is critical. If you’re the kind of person that blows-off your credit cards and other obligations, resulting in a low credit-score, what makes you think someone will trust you with their money?

It’s hard to prove your level of integrity on a loan application, which is why they want a decent credit score, a history of work ethics and honesty. Many hard money lenders want to see that you’ve been successful with money management. If you can’t show this, then look elsewhere for your funds. If the lender says your credit doesn’t matter, they are lying to you and will gladly take that up-front fee.

Let’s talk Financials

Pretty much the standard offering I see these days is 2-4 points, 12-14% interest rate for a 6 month term at a 70% loan to ARV (after repair value). These numbers may fluctuate depending on your level of experience with similar projects and similar loans.

- POINTS = percentage of the total loan amount. For example, let’s say an $80k loan on a $100k purchase price, with a $50k rehab budget, the points would be a percentage of $130k, paid at closing.

- INTEREST = The monthly payment on the total loan amount. Say a $130k loan at 12% interest will be $1300/month.

- REHAB BUDGET = Usually held in escrow, paid out after verification that the project has completed certain milestones, also called DRAWS

When I find an incredible loan rate from a reputable lender, I look into their fine print. One lender I know boasts an awesome 7.99% hard money loan, only to find out they will only fund 50% of the purchase price and none of the rehab cost.

Even the most reputable lenders will not disclose all of their fine print until you get to the closing table. That’s when it’s too late. You’ve already had a hard inquiry to your credit report, paid for an appraisal, gathered your funds for the purchase, lined up contractors and potentially lose your EMD (earnest money deposit) should you back out of the project. You may face this manipulation by the lender, but at this point you’re posed to make a 5 figure profit, so you let these miscellaneous fees slide. This is only one of the ways these guys will get you.

Another is in the extension fees. I’ve even had private lenders admit to me they make most of their money on the extension fees. Real Estate projects rarely come in on-time, and on-budget. There are always surprises during this process, and yet we are often in denial about this at the beginning of a project.

I remember being convinced I could punch out a project in Chicago within 6 months. But unsuspecting freezing days, contractor mishaps, a strike at the LA ship yard, my project was delayed. I did have it under contract to sell prior to the 6 months, and were my gap lender forgave the extension fee, the HML saw my profit (yes, it was a 6 figure profit) and wouldn’t budge from the 6 month deadline.

In Conclusion

Most hard money lenders basically revolve around these criteria. Some may try to differentiate themselves in varying ways, but if they quote something that seems to far off what was discussed here, take a close look at their fine print.

We Buy Houses Scams

How many times have you been at a stop light and seen the small curbside signs that read… “We buy houses and pay cash” or “We buy ugly houses”?

Is this a legitimate industry or just another scam?

There are genuine companies out there, however, you must protect yourself from those who are just trying to take advantage of your situation.

COMPANIES THAT OFFER TO BUY YOUR HOUSE. BUYER BEWARE!

Should consumers be cautious of companies that offer to buy your house? Absolutely!

Dishonest people prey on vulnerability. Consumers should always be cautious of business transactions, especially on one of this magnitude!

What does that mean? The Internet is filled with personal accounts of people that have been taken advantage of and who feel like they have been scammed. You need to be armed with enough knowledge so that you can recognize a scammer and their tactics.

ARE YOU A PRIME TARGET?

Scam artist typically go after people who will have trouble selling their homes in a traditional manner, for instance, with a Realtor®. If you feel like you have very little options and you answer yes to either of the questions below, you probably are at risk and vulnerable .

Do you have to sell quickly?

The most common reasons that owners need to sell fast is that they have a foreclosure or bankruptcy looming in their future. Most owners try to work out payments with the lender, but those who can’t are left feeling like they have very few options.

Does your home need repairs?

Cracked foundations, rotten wood, and water damage make selling your home to another family very difficult. Typically you will have to seek out an investor to purchase the home who has the right knowledge and is willing to spend the money to fix these issues

If you have enough time to list or market your property and your house maintenance is up-to-date, then you should feel confident that you will be approached by another loving family instead of a scrupulous con artist .

TOP TACTICS USED BY HOUSING SCAM ARTIST

Although there are multiple strategies used by these unethical groups, here are the ones typically used.

They told me on the phone it was an all cash offer

These guys will tell you whatever you want to hear in order to get a foot in the door. However, once they are in the door, they will undoubtedly try and persuade you to sell your house to them with owner-financing. They will try to have you deed the property to them while leaving the mortgage in your name.

Solution: There are times when owner financing makes sense. However, if they told you they would have a cash offer, then make them sign the contract showing all cash and have them provide a bank statement showing proof of funds.

They have the perfect solution for me… for a small upfront fee

After you are done explaining your situation to them on the phone, they let you know that they have the perfect solution for you and it will solve all your problems. All they require is a small upfront fee and they will give you the solution you have been looking for all along.

Solution: The Federal Trade Commission (FTC), the nation’s consumer protection agency, has a Rule in place to protect homeowners called the Mortgage Assistance Relief Services (MARS) Rule. MARS makes it illegal for companies to collect any fees until a homeowner has actually received an offer of relief from his or her lender and accepted it.

That means even if you agree to have a company help you, you don’t have to pay until it gets you the result you want. If you’re struggling to make mortgage payments or facing foreclosure, the FTC wants you to know how to recognize a mortgage assistance relief scam and exercise your rights under the new Rule.

And even if the foreclosure process has already begun, the FTC and its law enforcement partners want you to know that legitimate options are available to help save your home.

They need to send a few people over to look at the house.

After signing the contract they are planning on sending several people over to the house to view it. Translation: They are sending actual real investors to your house. Then they are planning on selling the contract to them for a wholesale fee.

Solution: If it is a wholesaler you are dealing with then you can expect that they are trying to get your property under contract with as little money and risk as possible. If they want an option period for more than 7 days, make sure you charge them a fee that they will not be ready to walk away from.

Also, you do not have to give them permission to have several people walk through your home. Typically, the only people that should walk through are a home inspector and any contractors they are using to get bids for repairs.

QUICK TIPS TO PROTECT YOURSELF

If you need to sell quickly for any reason and are going to consider a company that offers quick relief make sure you do your homework!

There are legitimate companies out there. Research them!

The internet offers a 24 hour resource to look into the partner you’re going to chose to do business with on one of the most important financial decisions you’ll ever make.

- Check to see if they are registered with the Better Business Bureau or have any complaints.

- Check out their website. Is their name on it? Why would they be scared to put their name on their website.

- Google the owner to see if they are or have ever been associated with any questionable situations.

- Ask questions, and most importantly

- Read your contract and make sure you understand it.

Remember you shouldn’t have to pay any upfront fees and if they are offering to buy your home they should be paying you.

IT MUST BE A TRUE WIN-WIN SITUATION

Obviously, even an legitimate ethical ‘We buy houses’ company is not going to pay full price for a house. They are in the business to make a profit just like everyone else. Now that said …keep in mind that a negotiation is only successful if both parties feel that they got a fair deal.

If you need to sell your home, possibly needing repairs, and reasonably quick, you will have to accept a lower price than you would typically list it with an agent. With the lower price you are offering, these companies are willing to accept the risk of paying cash to buy the house as is, no repairs, and provide quick relief to you.

When these companies make you an offer they use a formula that helps them to come up with the price. They consider the value of your home, the potential value once any repairs are made and the cost to make the home ready.

When you list your home with an agent or even a for sale by owner you incur costs than can include minor or major repairs, marketing fees, you pay commissions and you are in a waiting game not knowing when or if it will sell.

So what does that mean for you? If you are not restricted by a timeline it may be best to invest the time and money to “prepare” your home for viewing and list it on the market. If you are on a short timeline for any reason there are legitimate companies out there that can help. Just make sure you check them out. If you are looking to sell your house, check us out, we are professional home buyers and we buy houses around Austin TX! Please Contact us.

Hornet Capital Announces Stellar Returns for Investors

Austin, TX, August 6, 2018 – Hornet Capital is pleased to announce double digit annualized returns for Fund Investors in their first quarter in business (Q2, 2018).

The umbrella of Hornet Capital companies boasted a 12% annualized return for the company, a phenomenal feat for any businesses in its first quarter. The Fund declared the preferred return of 10% annualized for their Class A shares, and a 10.1% return for the Class B shares, a major win in this initial quarter.

“It was a busy quarter for us at Hornet Capital. Between the transition from Tally Two Investment Group and deploying funds expeditiously – yet strategically, we are confident we’ve established a solid portfolio to safely maximize investor’s returns” claimed CEO Brian Whitten.

Hornet Capital originated from Tally Two Investment Group, a real estate development company in Austin, TX. After many successful redevelopment projects since 2012, Brian saw the demand to help more developers continue in his path and established Hornet Capital, an investment fund to leverage successes for Austin area developers. “Any developer working with Hornet Capital has the added advantage of our experience and direction for their projects, ensuring the best possible outcome for all involved”, according to Whitten.

###

Austin Investors Continue to Reap Rewards from the Austin Area Housing Market

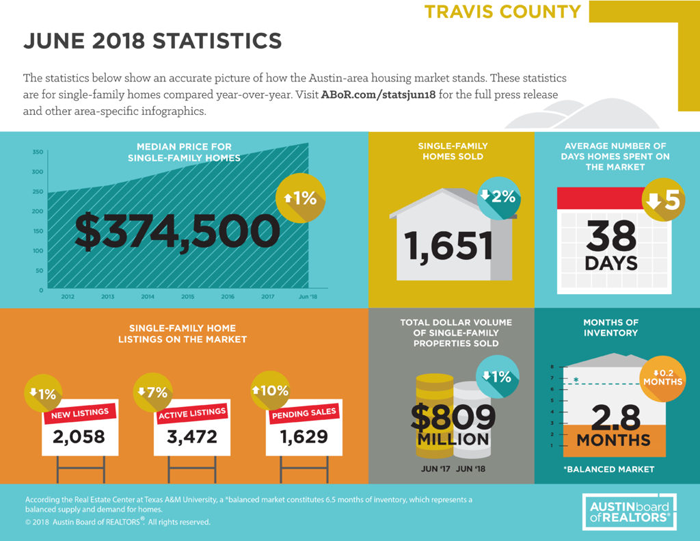

Single-family home sales in the Austin-Round Rock Metropolitan Statistical Area (MSA) experienced strong and steady growth in the first half of this year but declined in June 2018, according to the June & Midyear 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. In the first half of the year, area home prices continued to increase and housing inventory levels slowly declined amidst strong housing demand.

Blog NewNathan Malachowski2023-04-21T19:15:01-05:00